Household employee workers’ compensation insurance protects the caregiver and the employer from the expenses and liabilities associated with a work-related accident. A single accident can leave the household employer liable for thousands of dollars in medical bills. Don’t assume that this liability is covered under your Homeowner’s Insurance Policy!

Last updated June 28, 2024

Most states require household employers to carry Workers’ Compensation insurance for their household employees such as a nanny, senior caregiver or housekeeper. This insurance will reimburse an employee who was injured on the job for qualifying medical expenses and lost wages. If you don’t have a workers’ compensation insurance policy, you may be personally liable for your injured employee’s expenses. Perhaps more importantly, workers’ compensation insurance affords you legal protection because when an employee accepts benefits, he or she generally forfeits their right to sue you, the employer, regardless of fault.

Obtaining Workers’ Compensation Insurance: To be clear, workers’ compensation insurance is an insurance policy, not a tax. As such, it must be managed by a state-licensed insurance broker. Typically this nanny insurance is available through commercial ensurers, but some state funds exist as a provider of last resort where coverage is required by law. State funds are typically the most expensive method of obtaining coverage, as they must ensure all applicants, regardless of risk.

HWS has an exclusive insurance partner who will help clients easily obtain affordable workers’ compensation insurance coverage. HWS clients can receive a free quote for household employer workers’ compensation insurance. Contact us for more details.”

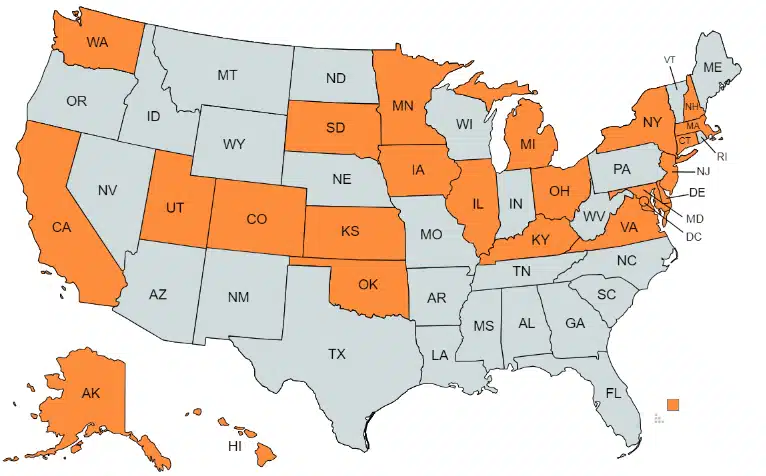

Our guides for household employment laws by state provide information and links for Workers’ Compensation Insurance in each state. The chart below is intended for informational purposes only, and is not specific legal or insurance advice. HWS strongly recommends all household employers speak to a licensed insurance agent and purchase this insurance when available.

*Household employers may also need to update automobile insurance if a household employee drives their personal vehicle. Be sure to check with your insurance agent about coverage.

Where Household Employers Need Workers’ Compensation Insurance

| STATE | REQUIRED FULL TIME | REQUIRED PART TIME | VOLUNTARY COVERAGE | NOTES |

| Alaska | Yes | Yes | ||

| Alabama | Yes | |||

| Arizona | Yes | |||

| Arkansas | Yes | |||

| California | Yes | Yes | Working 52 or more hours per quarter. Typically obtained as a rider on the employer’s homeowner’s insurance – talk to your licensed agent. | |

| Colorado | Yes | Regularly working 40 or more hours per week. | ||

| Connecticut | Yes | Yes | Regularly working 26 or more hours per week. | |

| Delaware | Yes | Yes | Earning $750 or more per quarter. | |

| District of Columbia | Yes | Yes | Working 240 hours or more per quarter. | |

| Florida | Yes | Required if employing 4 or more full or part time employees. | ||

| Georgia | Yes | Required if employing 3 or more full or part time employees. | ||

| Hawaii | Yes | Yes | Earning $225 or more per quarter. | |

| Idaho | Yes | |||

| Illinois | Yes | Regularly work 40 or more hours per week. | ||

| Indiana | Yes | |||

| Iowa | Yes | Yes | Earning $1500 or more per year. | |

| Kansas | Yes | Yes | Total gross wages to all employees $20,000 or more per year. | |

| Kentucky | Yes | Required if 2 or more full or part time household employees. | ||

| Louisiana | Yes | |||

| Maine | Yes | |||

| Maryland | Yes | Yes | All employers subject to Maryland Unemployment Insurance. | |

| Massachusetts | Yes | Yes | Regularly working 16 or more hours per week. | |

| Michigan | Yes | Regularly working 35 hours or more per week. | ||

| Minnesota | Yes | Yes | All employers subject to Minnesota Unemployment Insurance. | |

| Mississippi | Yes | Required if 5 or more full and part time household employees. | ||

| Missouri | Yes | |||

| Montana | Yes | |||

| Nebraska | Yes | |||

| Nevada | Yes | |||

| New Hampshire | Yes | Yes | ||

| New Jersey | Yes | Yes | ||

| New Mexico | Yes | |||

| New York | Yes | Regularly employed 40 or more hours per week. Live in workers are required to be covered regardless of hours worked. | ||

| North Carolina | Yes | |||

| North Dakota | Yes | Employers must buy workers comp insurance from an insurance fund operated by the state. Call 701-328-3800 for more information. | ||

| Ohio | Yes | Yes | Pays wages of $160 or more per quarter. Employers must buy workers comp insurance from an insurance fund operated by the state. Call 800-644-6292 for more information. | |

| Oklahoma | Yes | Yes | Pays wages of $10,000 or more in a year. | |

| Oregon | Yes | |||

| Pennsylvania | Yes | |||

| Rhode Island | Yes | |||

| South Carolina | Yes | Required if employing 4 or more full or part time household workers. | ||

| South Dakota | Yes | Yes | Employed more than 20 hours per week for six or more weeks. | |

| Tennessee | Yes | |||

| Texas | Yes | |||

| Utah | Yes | Regularly works 40 or more hours per week. | ||

| Vermont | Yes | |||

| Virginia | Yes | Required if 3 or more household workers are employed. | ||

| Washington | Yes | Required if 2 or more household workers are employed. Employers must buy workers comp insurance from an insurance fund operated by the state. Call 800-547-8367 for more information. | ||

| West Virginia | Yes | |||

| Wisconsin | Yes | |||

| Wyoming | Yes | Employers must buy workers comp insurance from an insurance fund operated by the state. Call 307-777-7441 for more information. |

Resource: US Department of Labor Survey: STATE WORKERS’ COMPENSATION LAWS

Talk to your insurance company

We strongly recommend that you discuss your situation and your state’s insurance regulations with a licensed insurance agent. HomeWork Solutions’ household payroll professionals are not qualified to discuss specific insurance issues and will direct clients to our licensed insurance partner. We are happy to make referral of clients to our trusted insurance partner.

» HomeWorkSolutions.com Blog: Real Life Example

» US Department of Health & Human Services:Worker’s Compensation in the Consumer Market

» US Department of Labor Survey of State Worker’s Compensation Laws