Did you know that 39 states have now passed laws requiring employers to provide itemized pay stubs to their employees? Why all the attention to nanny pay stubs?

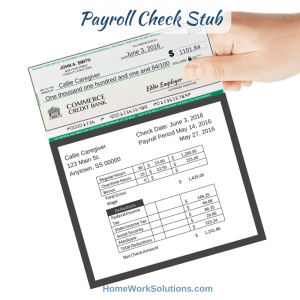

Laws mandating that employers provide employees with a pay stub recognize that without a pay stub, it’s much harder for the worker to tell if they’re being paid for all hours and if the deductions are right. Generally speaking, the itemized pay stub should include:

- Employer name and address (some require the employer’s EIN also)

- Employee’s name

- The dates covered by the paycheck

- The date of the paycheck

- The pay rate for regular hours and overtime hours

- The number of regular hours and overtime hours paid

- The gross wage computed (amount before any deductions)

- Itemized list of all deductions

- The net pay (take home, the amount of the check or direct deposit)

- Year-to-date accruals for all dollar amounts in addition to pay period amounts

Typical Deductions:

- Social Security and Medicare taxes, sometimes referred to as FICA

- Federal Income Tax

- State Income Tax

- Local Income Tax

- Other state taxes authorized by law, typically employee contributions to disability insurance

Other less common deductions from a household employee’s wage include employee contributions to health insurance and employee contributions to a retirement savings plan.

Also, if an employee owes their state or the federal government money for things like unpaid income tax, unpaid property taxes or fines an employer may be required to “garnish” your paycheck. This is a court order the employer must follow until the debt is paid. The employee can go to court and ask for the amount to be lowered if what is being taken is believed to be too high for you to be able to survive.

Which states require pay stubs? |

|

State |

Required? |

Clarification |

|

Alabama |

NO |

|

|

Alaska |

YES |

Applies to all employers |

|

Arizona |

NO |

|

|

Arkansas |

NO |

|

|

California |

YES |

Applies to all employers |

|

Colorado |

YES |

Applies to all employers |

|

Connecticut |

YES |

Applies to all employers |

|

Delaware |

YES |

Employers with 3 or fewer employees exempt |

|

District of Columbia |

YES |

Applies to all employers |

|

Florida |

NO |

|

|

Georgia |

NO |

|

|

Hawaii |

YES |

Applies to all employers |

|

Idaho |

YES |

Applies to all employers |

|

Illinois |

YES |

Applies to all employers |

|

Indiana |

YES |

Applies to all employers |

|

Iowa |

YES |

Applies to all employers |

|

Kansas |

YES |

When requested by the employee, required. |

|

Kentucky |

YES |

Employers with fewer than 10 employees exempt |

|

Louisiana |

NO |

|

|

Maine |

YES |

Applies to all employers |

|

Maryland |

YES |

Applies to all employers |

|

Massachusetts |

YES |

Applies to all employers |

|

Michigan |

YES |

Applies to all employers |

|

Minnesota |

YES |

Applies to all employers |

|

Mississippi |

NO |

|

|

Missouri |

YES |

Applies to all employers |

|

Montana |

YES |

Applies to all employers |

|

Nebraska |

NO | |

|

Nevada |

YES |

Applies to all employers |

|

New Hampshire |

YES |

Applies to all employers |

|

New Jersey |

YES |

Applies to all employers |

|

New Mexico |

YES |

Applies to all employers |

|

New York |

YES |

Applies to all employers |

|

North Carolina |

YES |

Applies to all employers |

|

North Dakota |

YES |

Applies to all employers |

|

Ohio |

NO |

Only required if you are 18 years or younger! |

|

Oklahoma |

YES |

Applies to all employers |

|

Oregon |

YES |

Applies to all employers |

|

Pennsylvania |

YES |

Applies to all employers |

|

Rhode Island |

YES |

Applies to all employers |

|

South Carolina |

YES |

Employers with fewer than 5 employees exempt. |

|

South Dakota |

NO |

|

|

Tennessee |

NO |

|

|

Texas |

YES |

Applies to all employers |

|

Utah |

NO |

Domestic service employers excluded from coverage. |

|

Vermont |

YES |

Applies to all employers |

|

Virginia |

YES |

When requested by the employee, required. |

|

Washington |

YES |

Applies to all employers |

|

West Virginia |

YES |

Applies to all employers |

|

Wisconsin |

YES |

Applies to all employers |

|

Wyoming |

YES |

Applies to all employers |

Last updated: May 1, 2016

Disclaimer: The information provided here is believed to be true as of the date of publication. This information is provided “as is” without warranty of any kind.