Small Business Payroll

& Tax Services

Make Payroll Simple

Employment Taxes & Payroll

Don’t wait. Start the conversation today. Let us handle all aspects of your small business payroll and taxes.

Focus on Your Business

We flawlessly handle small business payroll, taxes and compliance so you can focus on your client’s returns.

Simplify, not Sacrifice

We provide concierge-level service with a dedicated representative to answer your questions and address issues quickly.

What We Do

At HomeWork Solutions, we specialize in providing comprehensive nanny payroll services, including tax, payroll, and HR solutions. Our mission is to ensure accurate and timely filing of payroll tax returns, eliminating any worries about notices, penalties, or red tape.

Whether you’re an employer or a nanny, we take pride in serving our community and ensuring a smooth payroll process and nanny tax compliance.

Your payroll taxes filed on-time, automatically.

- Automated Processes: Streamline your payroll with automated processing, reducing errors and saving time.

- Easy End-of-Year Filing: Simplify your end-of-year filing with our guaranteed compliance at all levels.

- Time Tracker: Keep track of employee work hours accurately and efficiently.

- Guaranteed Compliance: Rest assured that all your payroll and tax obligations are met.

Expert Payroll Solutions

Our comprehensive payroll solutions are designed to take the stress out of managing your team’s wages, deductions, and filings. From employee onboarding to tax remittance, we handle every detail—accurately and on time—so you can focus on growing your business.

At HomeWork Solutions, we recognize that every business is unique. That’s why our flexible payroll options are tailored to meet your specific needs. Whether you run a family-owned shop or a fast-growing startup, our experienced team is here to provide the friendly, hands-on service you can trust.

Concierge level support from the experts in payroll and taxes.

We believe simplicity is key. That’s why there are no phone trees and you’ll always have full visibility into your account. You’ll also get a dedicated representative who will quickly handle any issues or questions that arise. We’re dedicated to superior customer service, no matter what.

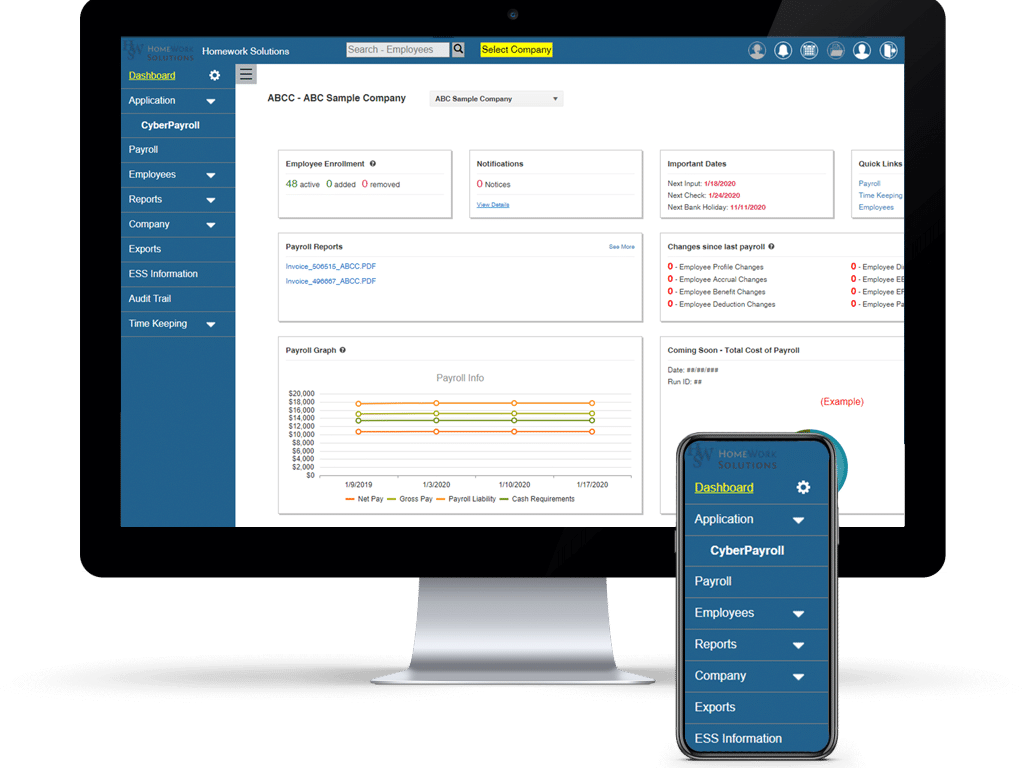

Powerful online account tools with 24/7 access.**

Our easy to use portal gives you full visibility of everything you need. It is flexible, available to access 24/7, and gives you the control you need to process your own payroll or to service your clients at the level they require.

We’ll make sure everything is filed.

We know your time is valuable. That’s why our simplified approach has worked for small business owners and financial professionals for over three decades. Whether it’s household payroll, 941s, or W2s, we will ensure everything is processed and filed, on time and accurately.

Automated Taxes

Taxes are filed for you, so you don’t have to lift a finger.

W2s and 1099s

We ensure there are no missing forms or paperwork from employees, so everything stays within compliance.

Payroll

Weekly, bi-weekly or monthly payroll processing – we have it covered.

New hire reporting

We will collect and report necessary data to the IRS and state, so you don’t have to worry about it.

24/7 Portal

Need access to payroll details after hours? No problem. Our portal is available 24 hours a day, 7 days a week.

Dedicated Customer Rep

You’ll be assigned a customer representative that is available to answer questions, provide guidance, and handle any issues that come up.

Frequently Asked Questions

Our services simplify payroll processing, ensuring compliance with both federal and local taxes. Our Premier Plan goes a step further and includes guidance on unemployment benefits and workers’ compensation, ensuring that you and your employees are fully covered. This plan also includes human resource expertise to provide guidance and payment processing for benefits administration like health insurance, onboarding, and more.